Scottie Resources – More High-Grade Gold Drill Assays Released From The Scottie Gold Mine Area Building Towards A Maiden Resource And PEA

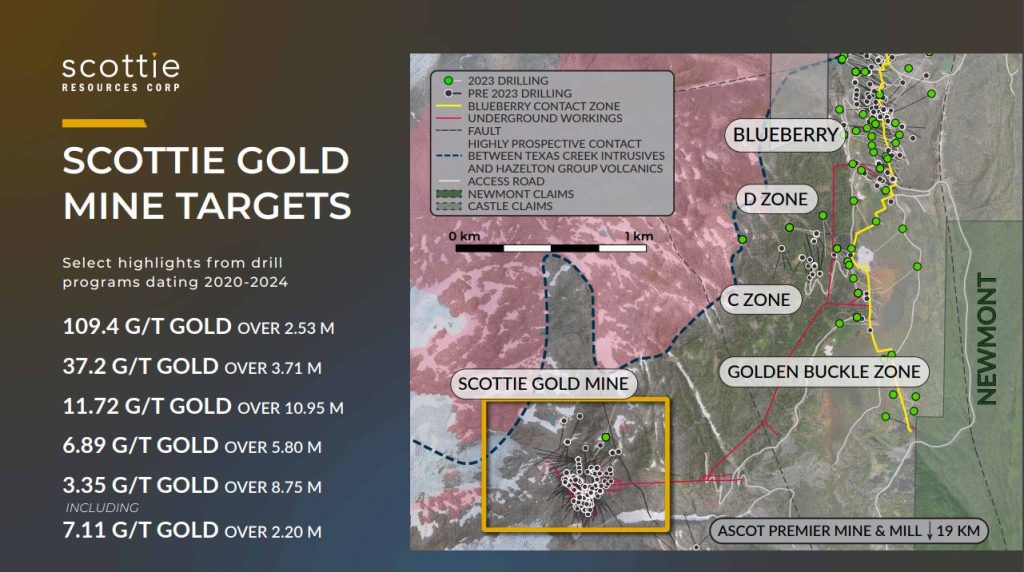

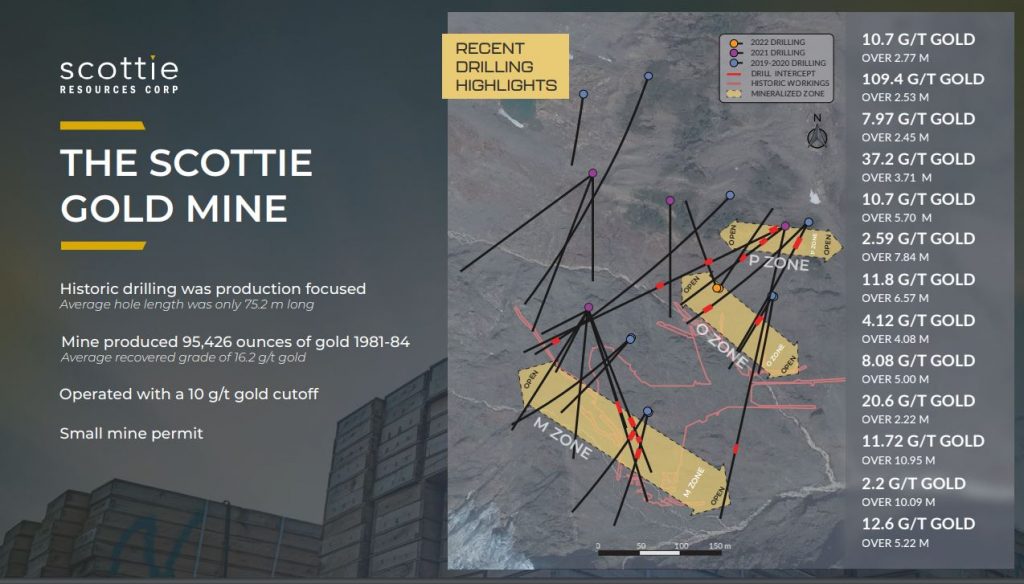

Brad Rourke, President and CEO of Scottie Resources (TSX.V:SCOT – OTCQB:SCTSF), joins me to review the next batch of high-grade gold drillhole assays released today from the M Zone, N Zone, and O Zone around the Scottie Gold Mine area from this year’s 10,000 meter drill program located in the Golden Triangle of British Columbia. We also discuss the larger Company strategy of consolidating all the prior drilling date along with this year’s drilling to build towards a Maiden Resource Estimate and Preliminary Economic Assessment (PEA).

Highlights:

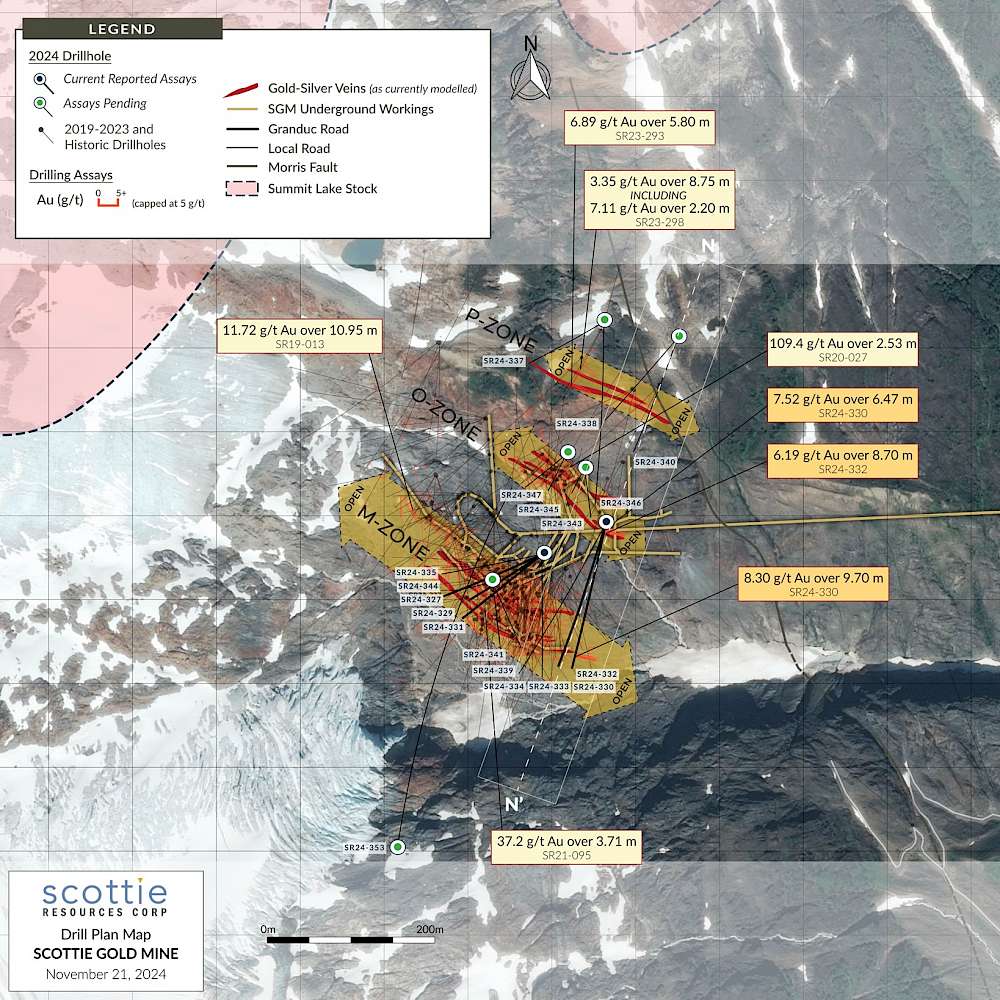

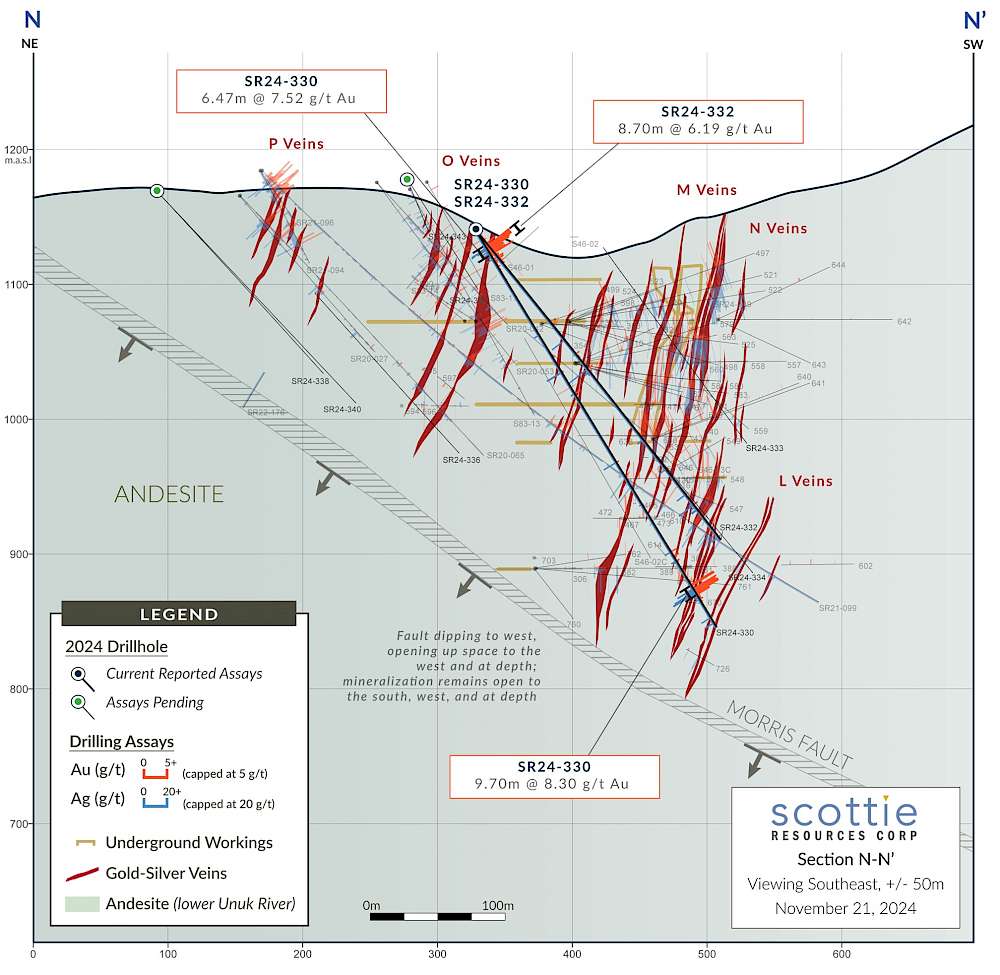

- SGM – drillhole SR24-330 intersected 8.30 grams per tonne (g/t) gold over 9.70 meters (m) including 10.30 g/t gold over 6.01 m in the N Zone and intersected 7.52 g/t gold over 6.47 m at the O Zone

- SGM – drillhole SR24-332 intersected 10.9 g/t gold over 4.20 m in a wider zone of 6.19 g/t gold over 8.70 m at the O Zone

- M Zone SGM drillhole SR24-327 intersected 26.1 g/t Au over 2.00 m

- The Scottie Gold Mine Project’s MRE planned for late Q1 2025 will be a combination of the historic Scottie Gold Mine deposit and the newly discovered Blueberry Contact Zone

Brad points out that while they anticipate around a million ounces of gold in their first resource estimate, that there are areas like the P Zone L Zone and more around the Scottie Gold Mine, and the C and D Veins, the Golden Buckle Zone, and the Domino area that are not going to be included in the resource, so there is definite upside to the mineralized inventory beyond what will show up in the first pass report. The strategy is just to get out the lowest hanging fruit for the resources thus far, and then wrap some earlier stage economics around the project with a Preliminary Economic Assessment later next year. We talk about other expansion areas and even untested targets that the exploration team will want to pursue moving forward with next year’s drill program.

Wrapping up I have Brad outline the rationale behind the share consolidation on a 6:1 basis that was announced on November 20th, to attract a wider roster of high-net-worth investors and funds that need a tighter share-structure. Then there are other value drivers the company is moving forward with in tandem like a technical study to outline permitting requirements, viability and timeline for potential mining of the historic Scottie Mine tailing piles, and initiating technical and market studies for the direct ship ore (DSO) sales and tolling through the Stewart export terminal for Asian markets.

If you have any questions for Brad regarding Scottie Resources, then please email them in to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Scottie Resources at the time of this recording.

.

Click here to visit the Scottie Resources website and read over all the news.

.

.

https://www.tradingview.com/x/SmdFKRgD/

NatGas: Expected Retracement

Head Fake Top!

Northvolt files for Bankruptcy in a Major Blow to European EV Industry. The writing was on the wall for a long time, but most people believed in The EV Nightmare. Volkswagen in Germany is cratering, and they pushed The EV Dream. LOL! DT 🤣

https://www.msn.com/en-ca/money/companies/northvolt-files-for-bankruptcy-in-major-blow-to-european-ev-sector/ar-AA1uyRAZ?ocid=msedgdhp&pc=U531&cvid=693a3fdff